Food Allergies: A guide to Italian travel

FOOD ALLERGIES IN ITALY

If you’re allergic to cats, it’s pretty simple to avoid petting one but food allergies are a bit more complicated. They...

The best time to visit Rome

BEST TIMES OF THE YEAR TO VISIT ROMEWhenever you visit Rome, it is definitely an incredible place to visit! However, you might want to...

How much does it cost to live in Italy?

LIVING COSTS IN ITALYBefore you decide to move to Italy, it would be wise to know how expensive it is and how much you...

Vocabulary essentials for your Italian holiday

VOCABULARY ESSENTIALS OF ITALIANLet’s face it - everything sounds 10 times more lovely in one of the romance languages. Italian has a way of...

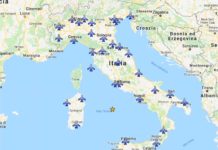

The train system of Italy and ticket options (Train Guides)

LOCAL TRAIN SYSTEM OF ITALYTraveling around Italy is really simple using the train system, whether it’s the national or private train service. You have...