REAL ESTATE BUYING GUIDE

The process of buying real estate can seem daunting even in your home country. But don’t be discouraged: buying property in Italy is quite simple and the process in Italy is pretty similar to the one in other countries.

After reading this article, you’ll be one step closer to owning the Italian home of your dreams and hopefully you won’t be scared of buying property in Italy anymore. Also, if you’ve never considered buying property in Italy before, we hope that this article will make you start thinking about it after you discover how simple it actually is.

Going through real estate agents in Italy is a safe process, since they are all required to pass exams and to be registered at the Chamber of Commerce. This guide applies to both off-plan and resale properties.

OFFERTA; PURCHASE OFFER

The real estate agent will assist in presenting a formal offer to the seller of the property. It will be written in both Italian and English and you will also have to make a down payment of 10%–20% of the total purchase price.

This payment makes the sale legally binding for both the buyer and seller if the offer is accepted by the seller. This is the caparra confirmatoria.

If either the buyer or seller would like to cancel the sale, one of the parties involved can claim damages to the property and the down payment is returned to the buyer.

If the seller backs out, the buyer may be eligible for a refund with additional fees paid by the seller.

COMPROMESSO; PRELIMINARY CONTRACT

In this phase all the details of the sale are outlined. All information is written in a preliminary contract if the seller accepts the offer.

The final purchase price and conditions of sale are in written down in this contract. Also, this contract has a detailed description of the property along with any allotted permissions or planning and catastal details (useful for taxes).

The contract is signed when the caparra confirmatoria is paid. Also, the commission fee, or provvigione, is paid to the real estate agent.

ATTO NOTARILE / ROGITO; DEED OF SALE

The deed of sale must be signed and transferred to the buyer in the presence of a notary, or notaio. The notaio is the only individual with the legal authority to transfer properties in Italy from one person or group to another.

The buyer is responsible for hiring and paying the notary. However, the notary should be completely unbiased and independent, as they are a public official and they are responsible for ensuring that all laws are followed during the sale.

This is obviously the most important step so we recommend finding an English speaking notary. This will make it easier for you to understand everything during the process. You can also ask detailed questions and expect clear, transparent answers, without miscommunications.

We also recommend using a bank account to transfer money and handling everything with a digital paper trail.

FINAL LOOK & PAPERWORK

Within 3 months of the sale at the notary (the official purchase date), the original copy of the deed of sale will be available to the buyer.

REAL ESTATE & TAXES

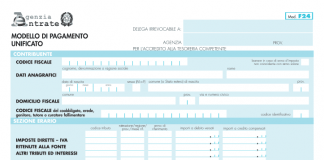

The government values the property in order to calculate the purchase taxes. This value on which the taxes are calculated is called the valore catastale.

You will also have to pay the registration tax or stamp duty, known in Italian as imposta di registro. This is 2% of the valore catastale if the buyer moves to Italy and applies for residence within 18 months of the sale.

However, if this is your second home in Italy or if it’s your first home but you’re not resident in Italy, then the registration tax goes up to 9% of the valore catastale.

If you sell the property within 5 years of purchasing it, you might have to pay an additional tax. If you’re selling the property at a higher price than what you bought it for, you will have to pay a tax based on your profit. This tax is 20% of your profit.

If you will be renting this property for additional income, this income will be taxed by the Italian government.

Each year, the property owner must report the profit made by renting this property with appropriate deductions (repairs, expenses, and local taxes paid). This income is then taxed.

Since you’re already paying taxes in Italy for your property, you won’t be taxed in your home country as well for your Italian property.

Local taxes also factor in property ownership. The IMU or TASI property tax, or imposta municipale sugli immobili, is a local council tax. If this is your first home in Italy and you have an Italian residence, you won’t have to pay the IMU tax.

The local government decides the percentage that you will have to pay each year. This is done in two payments, in June and December.

USEFUL VOCABULARY

Agente immobiliare = Real Estate Agent

Offerta = the purchase offer

Valore Catastale = Government-determined property value, normally around 30%–50% of the commercial price of the property

Catasto = Local Land Registry Office

Caparra Confirmatoria = Down Payment

Compromesso = Preliminary Contract

Provvigione = Real Estate Agent Commission Fee

Rogito / Atto Notarile = Final Deed of Sale

Notaio = Notary

Imposta di Registro = Stamp Duty / Registration Tax

Imposta Muncipale sugli Immobili(IMU or TASI) = Property Tax